With the iCREDIT Loan App, you can request a loan online, bypassing in-person complications that often arise in the traditional bank loan procedure.

It is also a fast way to obtain loans on short notice, using only a few requisites.

Most of the time, the terms and conditions under which the loan is issued will be quite amenable to your needs at the time, including some period for repaying the borrowed amount.

The iCREDIT Loan App provides quick cash in a matter of minutes, typically 10 although the official site promises a shorter time than this. As long as you meet the criteria for a loan request, you will find the iCREDIT Loan App a useful tool whenever you need money for miscellaneous reasons.

Since the app caters to online requests only, it requires every user to follow a set procedure. As a prelude, the first things to look out for are the criteria and good liaison (general phone and bank syncing for alerts, and seamless transactions).

Here is what the app offers.

It avails eligible users of a number of loan products, along with a structured borrowing bracket. Just like most loan apps out there, iCREDIT offers interest on an APR basis, which could run into two-digit figures depending on the amount borrowed.

Also, the expiry period is usually ninety-one (91) days.

However, there is a bit of an issue with the repayment pattern, compounded by the series of charges that also accumulate. We will get to this point later. Check out the iCREDIT Loan App features and packages in this post.

Read below for more information.

Also Read:

How Do Personal Loans Work? Get Secure & Unsecure Loans!

10 Criteria for Bank Business Loan | How Does It Work?

iCREDIT Loan App: How It Works

The site caps the record loan processing time as 5-10 minutes, given that the procedure doesn’t require overly long disclosures or any other details. So, there is less time spent on cursory details than would have been the case if banks provided the loan.

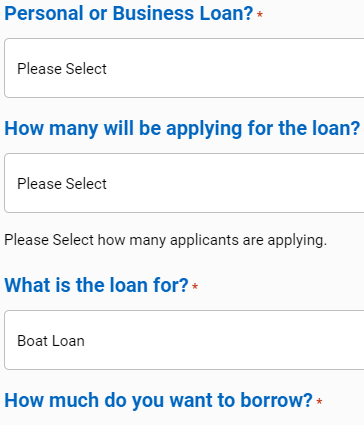

On the webpage, there is a request slip that facilitates the loan application, cutting straight to crucial details about the person applying for the loan.

It starts with this sequence:

Please Select — Personal Use & Business Use (pops up once you click on the drop-down icon).

How many will be applying for the loan — 1 or 2 (maximum is two persons)

What is the loan for — select from a list of locomotives, a horse, a caravan, etc. Also, you can choose a house.

The last entry on the page asks for the exact amount of money the person is looking to borrow from the company.

Note:

Other than the online web portal, you can use the mobile app to access the “loan products” on iCREDIT. The same offers are available in both cases. However, the app is more likely a handy widget, which gives it an edge over the website option.

Further, there seems to be an APK version as well, although this doesn’t expressly come from the providers of iCREDIT. So, it is literally not a viable option, to avoid sourcing loans from fraudulent app clones.

Back to the basic features of the app, the page essentially functions as a sign-up slip for anyone in need of quick cash. There is nothing else notable about it, except perhaps the APRs and tacked-on interests that come across as a tad exorbitant. (See the following section for details).

Is iCREDIT Loan App Affordable?

Of course, anyone can casually download any app from Google Play Store. But does that imply that the T&C of the loan is generally affordable? The answer is NO.

In this case, iCREDIT Loan App offers loans on relatively steep terms as the details divulge. Here is a preview of how a modest loan of four thousand (4000) naira could accumulate interest in a short period.

Suppose someone borrows 4000 naira from the company, the person will have to pay origination fees in the range of 1000-6000 naira and about five percent (5%) processing fee. Optionally, the money can be repaid in installments, forty-five (45) days for the fixed ninety-one (91) days period.

At the end of the period, the interest to be paid on this sum is ninety naira, along with up to eight hundred (800) naira origination fee. The payable amount is now two thousand, nine hundred (2900) naira.

If this pattern is kept on for the other half of the loan installment, the person would also have to pay up two thousand, nine hundred (2900) naira, making it one thousand eight hundred (1800) naira in excess payable on a four thousand (4000) naira loan.

So, it is actually a 45% interest. Likely, such a loan condition would discourage anyone that might need four thousand naira. On a light note, even 1200 or 800 would still be unaffordable on such a meager principal amount. That is one recurring downside to the fast loan apps online.

If you use the iCREDIT Loan App, you will get a 5%-36% APR. Also, you can factor in the rest of the charges and see how the payable amount per installment period adds up.

Everything would depend on the urgency of the loan, after all. The iCREDIT Loan App is ideal for someone looking to access funds on short notice, especially funds that are easily repaid in a couple of days. However, the app doesn’t really provide a financial lee for someone looking to repay loans over a long period.

You can download the iCREDIT Loan App using the steps in the following

How to Download iCREDIT Loan App

iCREDIT has a business-prepped website, but it doesn’t have any apps on Play Store.

People usually use the website to access the loan request slip. The download steps would typically be something like this:

- Search the official website for any iCREDIT Loan App Download icon.

- Click on the icon tag once you see it (if possible, inspect the link before clicking).

- Also, check that there is good user feedback appended to the download page.

Moreover, you will have to meet the following criteria to be eligible for a loan request.

iCREDIT Loan Criteria

- Ensure you upload a verifiable ID

- Also, you will need a functional and valid bank account.

- Only Nigerians are eligible.

- Verifiable evidence of a steady source of income.

- On getting to the iCREDIT Loan App page, you can request up to fifty-thousand (50000) naira. There might be a chance to get more than this — contact the CS for details.

P/S:

iCREDIT is not on the Google Play store for obvious reasons, worsened by the fringe demography it chooses to cover. Any loan app offering APRs of up to 36% isn’t permissible on Google Play Store.

Already, another brand, LCREDIT, had been outed in Nigeria as a fraudulent platform, considering its illegal method of calling in loans. iCREDIT sounds like a reboot.