Paysense Review has been coming from different angles, their customers have a lot to say about their services and management.

It is one thing to have a great vision for an organization during its establishment and an entirely different thing to keep to that vision without drifting even while it is coming up.

Paysense is a private lender in India that gives out loans to different Indian-based citizens to help them sort out their financial needs and be free from debt.

It is, therefore, advised that whatever you may be doing with any company, body, organization, or even a person and it is digital based, be sure to verify its genuineness and if it can be trusted.

That has to be why a lot of people have this question; “is Paysense trustworthy?” is the Paysense app safe to use? Is my information on the Paysense portal safe?

These questions and more like them are all reasonable and good for someone who even though it is not you is giving out your money. The information about you that you will be providing the organization is enough to get you concerned about their genuineness.

If you are worried about whether or not the Paysense loan app is genuine and safe, worry no more about all the information you need in answer to your mind’s questions are all answered in this Paysense Review.

Also Read:

Instant Cash Loan in 1 Hour Without Documents | 5 Best Lenders

Totok Loan | How to Download Toktok Pay | Is it Reliable

Paysense Review | What Is Paysense?

Paysense is a non-banking company that is based in India.

It is a financial business start-up that was established in 2015 to help customers, new and old, to get access to financial help to be able to sort out their financial needs.

Specialized in using advanced data science to give out credit to their needy customers without so much hassle and complex and or complicated application process.

Paysense as a non-banking company was established for the sole purpose of making the financial process of their customers much easier, simple, accessible, and very transparent.

Founded in 2015 by Prashanth Ranganathan, Paysense is a venture-backed financial services startup based in Mumbai.

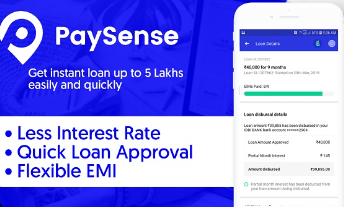

Giving their customers access to loans of low-interest rates and with no collateral through the Paysense mobile app or the Paysense official website.

Unlike other loaning organizations and companies, Paysense gives out its quick cash on clear grounds, not requiring a lot of document scanning and no loan collateral.

Partnering with a lot of well-known organizations and bodies in India, the company is well-established and rooted.

Paysense provides short-term loans to their customers and subscribers, to help them sort out their needs and emergencies without having to commit a crime.

Paysense Review | Get Instant Personal Loan

Over the years, Paysense has only concentrated on giving out loans to different people of different calibers to enable them to sort out their financial barriers and get them to stand back on their feet.

This loan has saved helped people pay off minor debts. used by different people to either settle hospital bills, pay children’s school fees, purchase a car, renovate their houses, and do several other things that they may need to do but lack the financial background to do it.

Whether a salaried or self-employed customer, Paysense grants loans to people on a low-interest rate basis and requests no collateral.

You can say that Paysense is a humanitarian-based organization even though it is mainly for the citizens and dwellers in India.

If you are up to 21 years and have a steady means of income that you can solidly stand on in repaying your debt, you can take out a Paysense loan to sort whatever need you may need to sort

You can easily repay your Paysense loan by simply going to the website or opening your Paysense mobile app and tapping on the “Paynow” Icon.

Payment can be made either through your debit card or net banking.

This payment method is by EMI.

With such competitors as InCred, Navi, IndiaLend, and LoanTap, Paysense has been working tirelessly to make sure that its customers are not disappointed.

When urgently needed, they make sure to always come through with an answer. Paysense has to be one of the best loan apps one would find in India.

Paysense Review | How Safe is Paysense?

If you want to take out a loan from Paysense, the first thing that should come to your mind is what are people saying about Paysense.

This question is as important as life itself. Having a fire knowledge of what people who have had business to do with the company will help you to know whether or not to continue your journey with them.

Although it is not what everyone says about the organization that you should digest, what people who have used the services and borrowed money from Paysense have to say about them matters.

Customer Feeback

Is it safe to upload my documents in Paysense? Paysense is encrypted and remains secured using SSL protocol so if you upload any of your sensitive personal documents on the platform it remains safe and secure for you.

Payment is well organized in a way that the information you have shared with them cannot be shared with a marketing agency which most people fear.