The PayU Login portal is available for everyone who wishes to enjoy simplified services, fast transactions, and seamless payments.

It provides an integrated mobile app for Android smartphones, enabling supported user tiers to access multiple features without going through different portals.

So, at a glance, PayU offers the best-localized payment processing service across many domains in Nigeria and outlier user areas. That is what the customers get to enjoy via the PayU Login webpage.

Will this platform provide efficient services? If you are looking to find an answer to this question, you need only look at the consumer feedback clip attached to the PayU review sites online. Also, you check typical feedback platforms online for likely reviews on PayU.

No matter where one looks up the PayU Reviews, the results are invariably the same — PayU provides the optimum experience for users.

You can enjoy these services as well if you have the right details and links to the corresponding platforms. Although feedback on the company’s performance has been generally positive, PayU provides unique experiences. Below is what you can expect from the company.

Alternative Ecosystem for Payments

The PayU login portal leads to the company’s designated e-commerce hub online. In that way, the customers can expect to enjoy loads of seamless online marketing services.

Using the simple UI features, PayU customers can easily place an order for goods, complete a dispatch request, and expect just the exact service they requested.

Also, apart from being an online money processor, it doubles as a bridge between purchasers and online merchants. Ultimately, PayU ensures an undisrupted flow of money from purchasers to sellers.

Bypass Regulatory Issues

Often, a new sole proprietor will have to sift through piles of regulatory paper works. It doesn’t bode well for the business if there should be any oversights or defaults to the owner’s record.

This is where PayU comes into the picture.

It serves as an integrator, connecting the seller and the buyer without encumbering the entire market chain with unnecessary legal checks.

As long as you are connected to the platform via the PayU Login, you can wave goodbye to frequent regulation from extraneous sources.

Reduce Complexities in Your Business

Have you been dealing with some issues due to logistics? If your business crosses several locations, then you probably have a broad consumer range to cover.

This could be a setback, especially if it is left unchecked. But it doesn’t have to be so. You just have to try an alternative processor — PayU.

In this article, we explain how the PayU Login procedure works, including a snippet of the basic framework used by the company.

Read on below for details.

Also Read:

Palmpay Login With Number | Digital Finance | Pros & Cons

PalmPay Code | Dial *652# Transfer &; Account Balance USSD

PayU Login | Access PayU in Nigeria

PayU is a global brand that has recently expanded its borders to the Nigerian e-commerce ecosystem.

Currently, there are several payment options and provider services — reference, Payment Services Provider (PSP) — covered by the company. Since it now has a solid footing within Nigeria, local businesses can easily key into the range of financial products offered by PayU.

Here is why the PayU Login Portal PayU Nigeria has been largely successful.

Multiple Payment Options

The various users (merchants, retailers, buyers, etc.) can interact via one mainframe. And that is the e-commerce interface run by PayU.

If you use this portal, you can easily purchase any preferred merch or product using multiple payment options as offered by the merchant. Supported pay channels can range from minor transmitters to global fintech payment media like PayPal or Stripe.

Elaborate Authorization Procedure

Unlike the passcodes that many e-commerce sites often use, PayU coopts an elaborate authorization procedure, ranging from transaction initiation and settlement to false declines.

PayU attempts to optimize the authorization so that services can get faster and more secure approvals than typical fintech apps could offer. As Such, it uses detailed verifications, which delegate part of the process to merchants, issuing banks, and only the minor relatively insignificant tasks to customers.

See below for how the PayU Login works on the mobile app and the web option.

PayU Login | Sign in Via App or Web Portal

If you wish to start using PayU for simplified and seamless transactions, consider downloading the PayU App for Android or iOS, complete the registration, and use the following sign-in procedure to access your profile.

As a prelim, go to App Store (or Play Store, if you are using an Android smartphone).

Fetch the entries for PayU and check that the latest app version matches the description on the provider’s official website.

Install the app on your smartphone.

Now, open the app and complete the sign-up process.

Subsequently, you can log in to your profile using your details.

Alternatively, you can go for the web portal PayU Login option. Sometimes it is easier than other methods unless you are using the PayU mobile app.

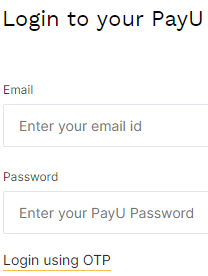

Here is how the PayU Login works on the web portal.

Go to the official website.

Click on the PayU Login icon on the homepage (otherwise, retrieve the feature from the menu tab).

Enter your PayU address and username.

Finally, click on Login.

Possible Glitches While Trying to Log in

If you are experiencing any issues while trying to access the official PayU Login portal, try any of these quick-fix tips.

Check that the details are correct.

Your login details must be an exact match of the ones you entered while creating an account on the site. S

o, if there is any detail that doesn’t reflect the ones already saved for the user, there will be automatic disapproval.

Verify that the App is Up to Date

Although this doesn’t happen quite often, some users tend to experience downtimes on their PayU app.

Perhaps rebooting the software would help. And in this case, this would just be a double-speak for an app upgrade. The best thing is to check if providers have rolled out new widgets or features that could boost the functionality.

But then, you don’t even have to upgrade the app at all. PayU has the app functions running nicely.

So far, the only downside to the PayU App has been getting used to the features. With time, this tidbit is easily mastered, and the user gets to access PayU services without any glitches.